Jump to winners | Jump to methodology

What it means to be a female leader in mortgage is changing, and that change is long overdue.

For years, success has been measured by a narrow standard of long hours, linear progression, and singular ambition, says Justine McDonald, a franchise owner and finance specialist at Nectar Mortgages.

“We need to rethink what leadership looks like. Let’s open the door to non-traditional paths, shared roles, flexible leadership models, and mentoring that meets women where they are at,” she explains. “We also need more women speaking at industry events, leading strategy, and designing the systems, not just adapting to them.”

This call for change comes as eight years of Senior Executive Census data shows incremental progress has stalled and, in some cases, gender equality is sliding backwards for the first time since the pandemic.

According to the Senior Executive Census 2024: Keeping Score of a Losing Game report:

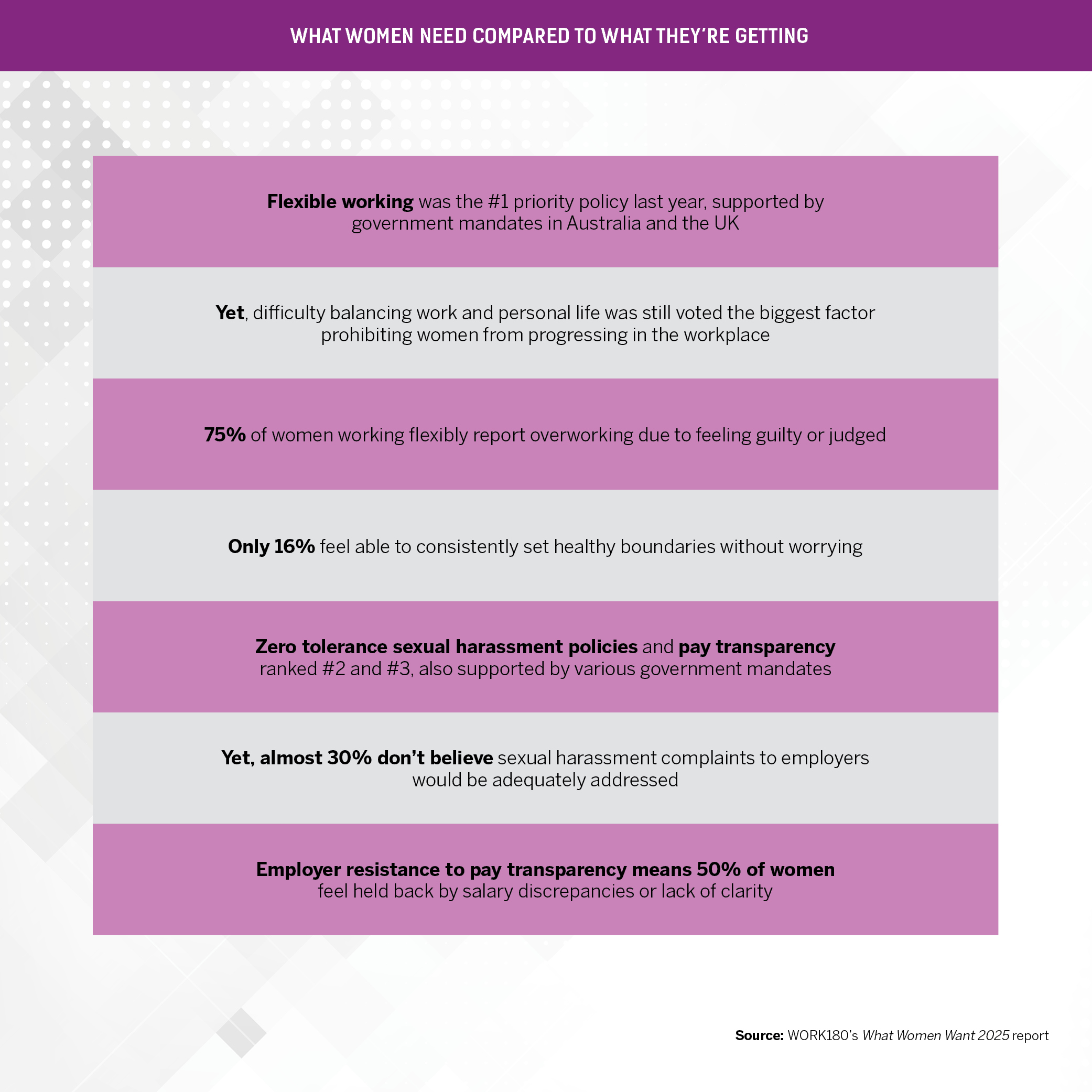

These numbers matter, states WORK180’s What Women Want 2025 report, and women are speaking up about why. Ninety-five percent report facing at least one barrier at work, while just over half (53%) believe conditions are improving and their top priority remains flexibility. In fact, 70% value it more than a top-tier salary. Pay transparency and sexual harassment policies follow closely behind as essential ingredients for thriving at work.

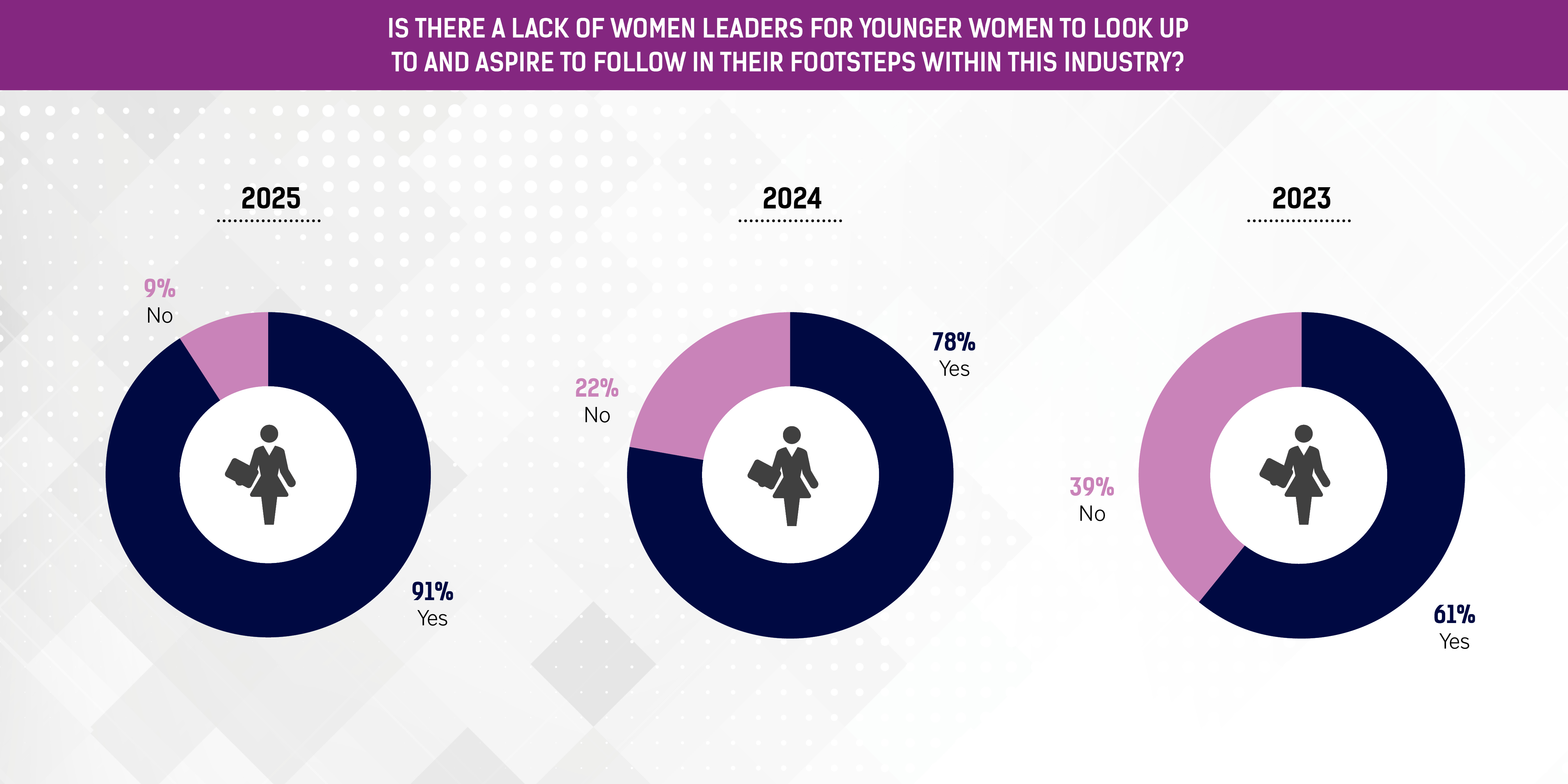

Within mortgage broking, concerns about representation are growing louder. In MPA’s latest three-year survey data, 91% of women in 2025 said there’s a lack of female leaders to look up to in the industry, up from 78% in 2024 and 61% in 2023.

This marked rise suggests the industry is moving in the wrong direction when it comes to visible leadership. For women entering or building careers in broking, the absence of relatable role models can reinforce self-doubt and make long-term progression feel out of reach.

Anja Pannek, CEO of the MFAA and an Elite Woman 2025 honouree, says the industry still has work to do.

The MFAA carried out its Diversity, Equity and Inclusion Survey in February 2024 to get members’ feedback about their experiences and perceptions of DEI in the lead-up to the MFAA’s inaugural DEI Summit in May 2025.

The survey found that over 50% of respondents believe gender barriers still exist. They identified the main barriers as being:

“Unconscious bias can affect workplace interactions, career promotion and recruitment, while a non-inclusive culture can affect the retention of women brokers and discourage women from joining the industry,” Pannek explains.

“Acknowledging and addressing these entrenched barriers is important to ensure we can make real progress, and this starts at the top, with our industry leaders.”

She adds that retention, not recruitment, is where the real challenge lies.

“The retention of women in broking is a greater challenge than recruitment,” Pannek says. “There’s a number of steps that can be taken to bolster retention and to enhance career development for women.”

She also points out that Australia is still trailing other major markets in female representation.

The proportion of female brokers in Australia’s mortgage broking industry is slightly lower, at 26.8%, than it is in the UK (30%) and the US (32.5%).

The mortgage industry wasn’t built with women in mind, and many are still finding their place in it, McDonald says.

“Too often, women carry the mental load of both family and career. Without strong support structures, something eventually gives,” she says. “That’s why community, coaching and permission to do business their own way matter so much.”

Pannek says the industry must do more to spotlight the unique upsides of broking for women.

“While women often have to juggle work, family and child-caring responsibilities, there are some fantastic advantages of a career in broking such as the freedom of running your own business, and the absence of a gender pay gap,” she says. “The industry needs to promote these benefits.”

Inclusion alone isn’t enough for women. McDonald says, “They want to be supported in a way that recognises their whole life, not just their business output. Policies that enable true flexibility, mental health support, leadership coaching and pathways for career re-entry after a break are essential.”

Culture counts just as much as policy, and women thrive where they feel safe to lead as themselves.

The proportion of female brokers in Australia remained stable at 26.8% as of September 2024, but in real terms, more women are entering the field, although at a slower rate than men.

MFAA data shows a 5.6% year-on-year increase in women joining the profession. This growth occurred as the total number of brokers reached a record high of 22,265, indicating that the rise in female participation is part of a broader expansion across the industry, with residential and commercial lending volumes at new peaks and mortgage brokers holding a 74.6% market share.

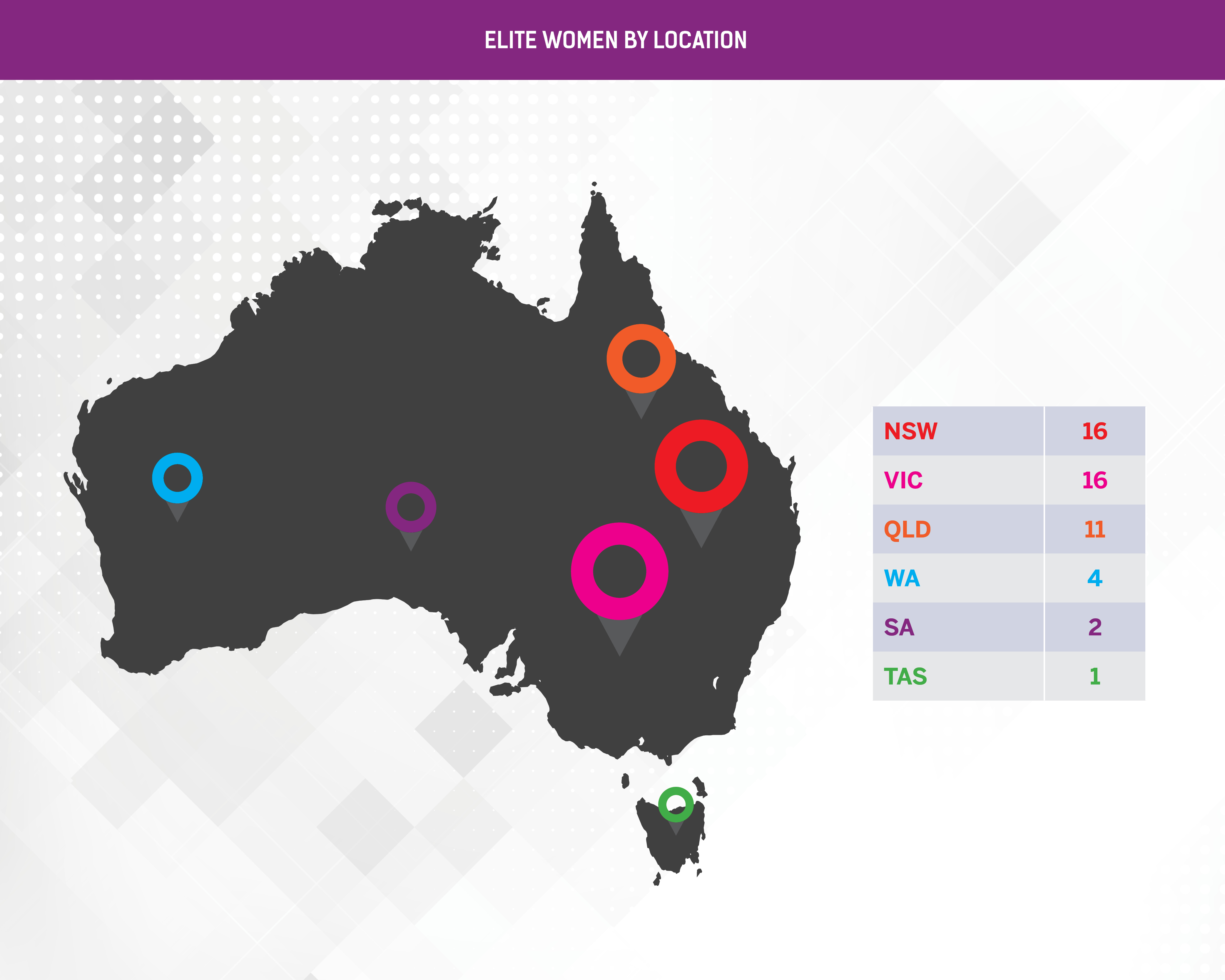

MPA’s 2025 Elite Women remind the industry of what it takes to move things forward. This year’s Top 50 female leaders were selected through a rigorous nomination and review process. Each has achieved standout results and driven change through innovation, mentorship and leadership that’s helping shape a new era in mortgage broking.

“There are many incredibly talented women in the mortgage and finance broking industry achieving great things for themselves, their businesses and their clients,” says Pannek. “An Elite Woman is someone who exemplifies excellence in everything she does. She is dedicated, passionate and highly professional in serving their customers, working with colleagues and industry partners.”

McDonald believes that female leadership shouldn’t be measured solely by revenue targets. Modern leadership must be about building a business that reflects personal purpose and brings others along.

“An Elite Woman measures success by whether her work gives her the life she wants,” McDonald says. “She uplifts others, builds safe spaces for honest conversations and is confident enough to ask different questions, starting with, ‘Is this business serving my life?’ instead of ‘How can I hit that next target?’”

She adds, “At Nectar, we are proud to have almost double the industry average of female brokers,” she adds. “That didn’t happen by chance. It came from changing the conversation, creating safer spaces and helping women build businesses that reflect the life they want, not just the targets they’re told to chase.”

Christa Malkin didn’t set out to break barriers but has done so regardless, by building trust, delivering results and earning influence across lending, broking and now aggregation.

After returning from maternity leave, Malkin joined AFG and took on leadership of its Strategic Partners program. From there, she stepped into the role of state manager for Victoria, then into the top aggregation post – a series of deliberate moves that widened her remit across the business.

As Victoria state manager, she was one of five women running AFG’s state-based teams, reshaping what leadership looked like across the country. “My replacement is a man, and he’s fabulous, but it was amazing to have five women running this key part of the business.”

Malkin doesn’t believe in performative leadership. She leads by example and expects her team to do the same. She explains, “If you say you’re going to do something, do it. Lead with authenticity. Provide people with a sense of where they’re going. If you’re not walking the walk yourself, you can’t expect people to follow.”

That approach, she says, sets the tone. “If we’re all doing that with our teams and it filters through the organisation, we create a culture where people want to do the right thing.”

Her experience across various sectors has shaped her leadership perspective. In addition to her work in banking and aggregation, she once served as general manager of a horse-racing training business. The contrast confirmed her belief that leadership has less to do with industry and more to do with consistency.

Mentorship also runs through her work. She often hears from women who hesitate to put their hands up for leadership roles.

“If a man ticks one box out of five, he’ll go for it. If a woman doesn’t tick one out of five, she won’t,” says Malkin. “We expect perfection from ourselves, and that holds us back.”

She reminds women that their strengths are often what set them apart. “Generally speaking, women are better organised, more likely to follow through and bring empathy into everything they do,” she says. “That’s what clients want, someone who communicates, who delivers, who’s across everything.”

Flexibility, she believes, should be non-negotiable, especially for those raising families. “If someone needs to pick up their kids or go to a doctor’s appointment, that’s just part of life,” she says. “It’s not about clocking hours. It’s about delivering. If the work isn’t getting done, often that’s a capability issue, not a flexibility issue.”

One of AFG’s partnership managers, who is returning after having her second child, will start back part-time before gradually building up to full-time hours. “It’s a no-brainer. That kind of transition matters,” says Malkin.

She believes people do their best work when they’re treated like humans, not resources. “You’re going to crush people otherwise. They’ll burn out, and you’ll lose great talent.”

Relationships were the starting point, and word of mouth has carried McGinty’s reputation further as she built her business by putting people first.

Her style is hands-on and personal, staying close to her clients and keeping the community at the heart of everything. Under her leadership, Preston Point Capital has won back-to-back Better Business Awards for Best Community Engagement Program and been named a finalist for Best Customer Service for two consecutive years.

“My business thrives on referrals and returning clients, a testament to the trust and satisfaction I’ve built over time,” McGinty explains. “Specialising in the investor and SMSF space, I understand the unique needs and aspirations of my clients.”

Alongside her brokerage work, McGinty plays a visible role in shaping the industry. A two-time finalist for Industry Thought Leader and a regular speaker at major events, including a recent on-stage interview at the Better Business Summit 2025 in Queensland, she brings an insider’s view shaped by time spent with clients.

She also sees business as a force for good. Through her advisory role with The Brewers Lunch, she has helped raise over $460,000 for health and community organisations across Queensland.

McGinty also brings practical experience to the table, with a thorough understanding of regulations and a focused approach to complex financial work. Progress matters to her, but so does how the job gets done. That’s shown by how her team remains responsive, collaborates well and follows through with care.

Inclusion is part of her day-to-day, and McGinty creates space for other voices, invites honest conversation and takes the time to listen. She asks the questions that move a team forward and speaks up when it counts.

But what defines her most is how she builds others up. Whether she’s mentoring a colleague, guiding a client, upholding ethical standards or supporting a local cause, McGinty helps others do the same. Her focus remains on helping clients and communities move forward as those values and actions have made her a trusted leader and role model.

“I believe my influence stems from a consistent commitment to excellence and impactful community engagement in the mortgage industry,” she adds.

It’s no small task to reshape how one of the country’s leading aggregators approaches innovation and broker support.

At Finsure, Dib has focused on building tools that brokers rely on, while strengthening the group’s global support model. She also helped drive expansion into Manila, opening the door to greater service capacity for brokers in Australia and New Zealand.

“Real innovation is a process with unique ideas that enhance efficiencies or solve new problems. People associate innovation with technology, but it’s broader,” Dib explains.

“Anyone can bring ideas forward. If you’re not innovating, you’re not being inclusive. True innovation doesn’t discriminate, it is gender-agnostic, age-agnostic and culturally agnostic. A truly inclusive process.”

One of her lasting contributions is launching an industry-first scholarship program through Women in Finsure, designed to help female brokers in Australia and New Zealand build sustainable, resilient businesses. Each scholarship, valued at over $15,000, includes executive coaching, tailored marketing and IT support, financial literacy and one-on-one mentoring through the Finsure Broker Academy.

The early discomfort of feeling out of place in a male-dominated industry drove Dib to identify the barriers that kept women from entering or staying in mortgage broking.

“I sat on it, woke up the next day, and said, ‘No, I’m going to be me’. At some stage, I’ll be so successful that they can’t ignore me. Industry culture will need to change, not me,” she says.

Determined to create lasting change, she collaborated with industry bodies to establish subsidised fees, mentoring programs and practical support, helping women build confidence and achieve success.

Her reach cuts across aggregation and into broader industry work. In 2015, Dib founded The iWoman Project, a social enterprise focused on financial education and empowerment. It helps women build financial independence and make informed decisions about their careers and futures through workshops and mentoring.

“I’m a big advocate for women in our industry, but it has become more personal. For me, it’s about being a role model for my four daughters and remembering that it counts even in my own home,” she says.

“They’re all older now and in their own careers but I see it in the way they operate and realise every word and action around them is moulding them.”

Spanning credit repair, financial education, and support for women, Kerry Sainsbury’s success is based on mentoring and community partnerships.

Impact, Sainsbury says, is achieved through small wins, from clearing a default and repairing a credit score to a client finally being able to move forward.

As CEO of Credit Success, she’s helped thousands of Australians regain financial control. Turning credit repair into a means of providing second chances for clients facing financial hardship is what underpins her dedication to helping others.

Over the past year, Sainsbury has grown the company’s broker referral network through trust and education. That same focus shapes her podcast, Wealthy and Wise with Kerry Sainsbury, which brings raw, genuine and current financial conversations to the public, often amplifying women’s voices in the process.

“What keeps me going is the passion for education and making a difference in clients’ lives,” she reflects. “There’s not enough awareness in terms of credit reporting, in Australia, in particular. The credit reporting system is evolving so much, but there’s little awareness unless it comes from a financial professional like myself or a mortgage broker.”

Clients often come to her after being denied finance due to unexpected credit issues, and her team’s ability to resolve the problems can be life-changing, restoring hope and financial opportunity.

“They come to us in such a state because they’ve realised there’s no next journey unless we can fix it,” she says. “You’ve got to come from a non-judgemental place. When we’re able to fix these issues due to errors or compassionate grounds, that’s a really nice story.”

Recognising the impact of mental health, Sainsbury maintains balance through daily walks with her dog, and her Pilates exercises, which alleviate the emotional weight of her work and highlight the importance of self-care.

She has also strengthened her mentoring efforts, supporting women in business ownership and finance, while continuing Credit Success’s partnership with Safe Haven Community, a charity that provides refuge to women and children escaping domestic abuse.

What sets Sainsbury apart is the ability to connect with individuals on a personal level, particularly when they are feeling overwhelmed, stuck or unheard. She acknowledges that things can feel cold and transactional in the credit and banking industry, but she and her team focus on empathy and trust.

“I truly listen to people, understand their problems and constantly try to find a solution to make things better, even when it is hard,” she says. “I’ve also learned to trust myself. Balancing my career, parenthood and caring for people around me is not always simple, but it is what keeps me grounded.”

MPA’s Elite Women for 2025 are driving the industry forward and transforming the way leadership operates.

Together as a group, they are:

redefining success on their own terms

backing flexible business models

Their work and standards question the old rules and make room for others to grow.

ANZ is proud to once again sponsor MPA’s Elite Women report, now in its fourth year. This report shines a spotlight on the remarkable women shaping the broking industry. The women honoured in the report are recognised for their dedication and expertise in helping Australians reach their homeownership or business goals, whether as brokers, aggregators or lender representatives.

These women represent the strength and diversity of our industry, and we’re delighted to celebrate their success in partnership with MPA. Acknowledging their achievements reinforces the value of inclusive leadership and the positive impact it brings to customers and communities across the country.

We remain committed to working better together with brokers, aggregators and industry partners to promote a culture that is inclusive, empowering and enriched by diversity. Through strong collaboration and shared purpose, we are helping to shape a future that reflects the communities we serve – a future driven by innovation, representation and opportunity.

It’s a privilege to continue supporting these outstanding women and recognising the vital role they play in leading our industry forward.

Natalie Smith

Natalie Smith

General Manager

ANZ Retail Broker

In March of this year, MPA invited industry professionals from across the country to nominate exceptional female leaders for its Elite Women 2025 list. Nominees had to be working in a role that related to, interacted with or in some way impacted the industry. They should have demonstrated a clear passion for their work and have never previously been recognised as MPA Elite Women.

Nominators were asked to describe the nominee’s standout professional achievements over the past 12 months, initiatives and innovations, and contributions to the mortgage industry.

After a thorough review of all the nominations, the MPA team narrowed down the list to the final 50 Elite Women who have made their mark on the industry.

MPA’s Elite Women report is proudly sponsored by ANZ.