Jump to winners | Jump to methodology

The leading women in the US mortgage sector go beyond just top executives; they are change agents, mentors, and community builders, and their success stems from a combination of innovation, resilience, inclusive leadership, and a relentless focus on people − both customers and team members. These women are not only shaping their organizations; they are redefining the standards of leadership in the mortgage industry.

The most successful female leaders in the mortgage industry stand out not just for their technical expertise but for how they blend heart and strategy, empathy and data, vision and execution.

Their talents lie in lifting others while reshaping the mortgage experience for both professionals and clients. Mortgage Professional America’s Elite Women 2025 were selected after reviewing each nominee’s standout professional achievements and contributions to the industry over the past 12 months.

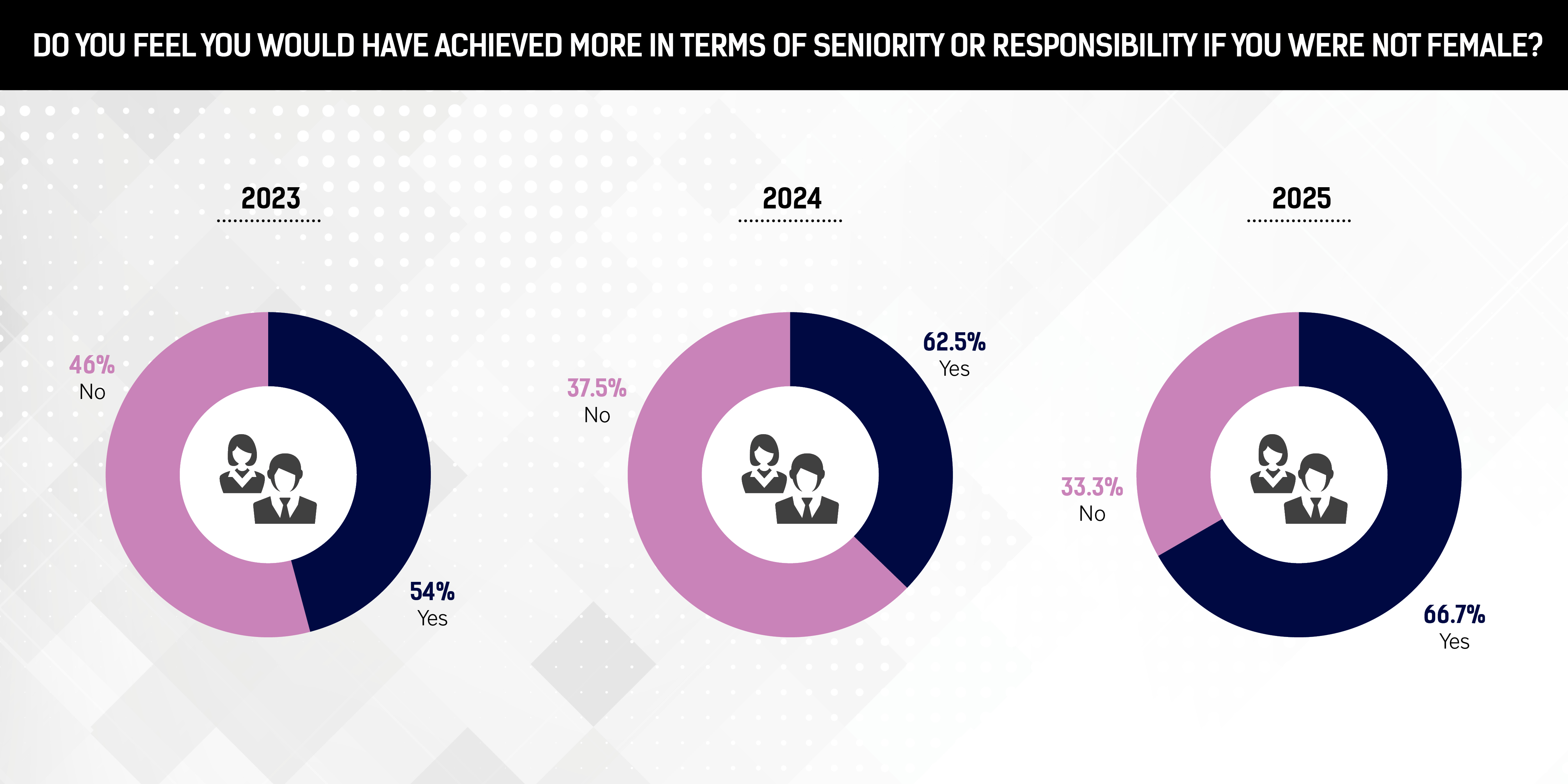

Their success can’t be taken for granted as women still face a complex matrix of challenges in the US mortgage sector, from ingrained industry bias to personal sacrifices and lack of representation. However, 2025’s Elite Women are rewriting the narrative by building networks, demanding change, and leading with both innovation and empathy.

Based on an analysis of the winners’ credentials and achievements, a clear profile emerges of the characteristics that drive success in the dynamic and evolving mortgage field.

1. Strategic leadership and executive impact

Most hold senior leadership roles such as COO, EVP, SVP, president, or founder.

They lead key functions, including product development, sales, operations, legal compliance, and strategic expansion.

They have a strong track record of guiding organizations through growth phases, acquisitions, digital transformation, and structural innovation.

Examples: Amanda Morrow (director of investor relations, Atlantic Bay Mortgage Group), Rachel Caple (chief revenue and sales officer, Geneva Financial), Michelle Constantine (EVP and co-founder, Newfi Lending)

2. Innovation in technology and operations

These leaders consistently drive the adoption of technology, from digitized closings and AI integrations to CRM systems and loan origination software.

They emphasize operational efficiency, process automation, and technology-driven customer experiences.

Examples: Lori Johnson (COO, DocMagic), Amy Hulett (director of enterprise sales, ARIVE), Tawn Kelley (president, Taylor Morrison Home Funding)

3. Culture building and mentorship

The Elite Women share a focus on building strong, people-first cultures that emphasize collaboration, mentorship, and employee engagement.

They actively mentor women and underrepresented groups, both within their organizations and through industry forums.

Examples: Julie Yarbrough (managing partner, Empire Home Loans), Christy Mindell (SVP, Champions Funding), Alison Williams (EVP, Walker & Dunlop)

4. Community engagement and advocacy

Many of these leaders are heavily involved in philanthropic work, especially related to housing, youth, education, DEI initiatives, and veterans.

They often lead or support industry efforts that bridge professional impact with community service.

Examples: Paula De Santi (Utah Hispanic community support), Jeanne Kelly (credit education), Rachel Caple (autism awareness), Zabrina Robaina (Children’s Miracle Network Hospitals and inclusion initiatives)

5. Personal resilience and inspirational journeys

Many of the Elite Women have overcome significant adversity or professional challenges, transforming those experiences into platforms for leadership.

Their journeys often involve career reinvention, pioneering efforts in male-dominated sectors, or founding their own businesses.

Examples: Jeanne Kelly (CEO, Kelly Group Coaching), Inga Springman (area manager, Citywide Home Mortgage), Aida Yousif (senior mortgage originator, Peoples Bank & Trust Company)

6. Market and revenue growth leadership

These professionals lead revenue-generating teams and drive market share expansion.

Several women developed new departments or revitalized underperforming business units.

Examples: Katrina Mizuuchi (mortgage department manager, University of Hawaii Federal Credit Union), Dawn Dawson (chief marketing officer, Mortgage Solutions Financial), Alison Williams (EVP, Walker & Dunlop)

7. Industry visibility and influence

Many hold leadership roles on national boards, speak at high-level conferences, and contribute thought leadership through publications and panels.

Examples:

Ingrid Jaschok (SVP, Cenlar) – served on panels such as the Five Star 2024 Mortgage Servicing Forum, Aisle Fireside Chats, Legal League members, the 2024 Spring Servicer Summit, American Bankers Association Risk & Compliance Conference’s “Navigating Through the Sea of Hot Topics in Mortgage Servicing.”

Jennifer Gormer (CEO, Integrity Home Lending) – founded Black Mortgage Professional Alliance and 2024 UWM Mortgage Broker Council member.

Katrina Cole (branch manager, Guild Mortgage) – 2024 Affiliate Service Partner of the Year and 2025 Chairperson for the Greater Regional Alliance of Realtors Young Professionals Network, 10-year team member of the Michigan Mortgage Lenders Association West Chapter, 13 years as supporting board member for Women’s Council of Realtors West Michigan.

Tawn Kelley – director on the Mortgage Bankers Association Board of Directors and serves on the MBA Residential Board of Governors. Regular contributor on the National Association of Home Builders Mortgage Roundtable, Chase Advisory Board, and J.P. Morgan’s Mortgage Finance Executive Forum.

Understanding the value they provide in their roles across the mortgage industry is key for female leaders such as MPA’s Elite Women.

Lauren Blackburn, director of marketing at American Financial Resources, says, “My biggest strength is my ability to combine strategy with innovation, seeing both the big picture and the details that drive real impact. I excel at creating and executing marketing strategies, driving process improvements, and enhancing client experiences.”

The National Association of Mortgage Brokers’ (NAMB) chief strategist Valerie Saunders notes, “As a strategic thinker and industry advocate, my leadership at NAMB has strengthened the industry through education, advocacy, and innovation, ensuring mortgage professionals have the tools they need to succeed.”

1. Visionary leadership and strategic thinking

Many cite their ability to see the bigger picture, set a long-term vision, and influence the future of the mortgage industry through advocacy, innovation, or policy.

Strategic leadership is not focused only on individual success; it is often paired with a desire to elevate the industry as a whole.

2. Mentorship and empowerment

A standout pattern is the deep commitment to mentorship, coaching, and people development.

These professionals are driven by a desire to grow others, lift them up, and build inclusive, opportunity-rich environments.

They don’t just lead − they intentionally bring others with them.

3. Adaptability, resilience, and change orientation

Several respondents describe resilience as a foundational trait − often forged during challenging industry moments (e.g., entering the field during the 2008 financial crisis).

They embrace change as a catalyst for growth, innovation, and personal development.

4. Strategic innovation and problem solving

These leaders are often operational strategists − skilled at improving efficiency, driving innovation, and identifying both challenges and solutions.

They frequently combine data-driven thinking with creativity to enhance client and organizational outcomes.

5. People-first leadership and emotional intelligence

A deep care for relationship-building, listening, collaboration, and empathy is prevalent.

Many highlight their ability to read people well, ask thoughtful questions, and guide others in both personal and professional growth

6. Industry advocacy and education

Several mention industry advocacy − especially in policy, broker representation, and consumer education.

These leaders see themselves as change agents, working to elevate standards and promote access to sustainable homeownership.

One of 2025’s winning cohort, Shannon Santos, underlines hurdles that women face, which still exist today.

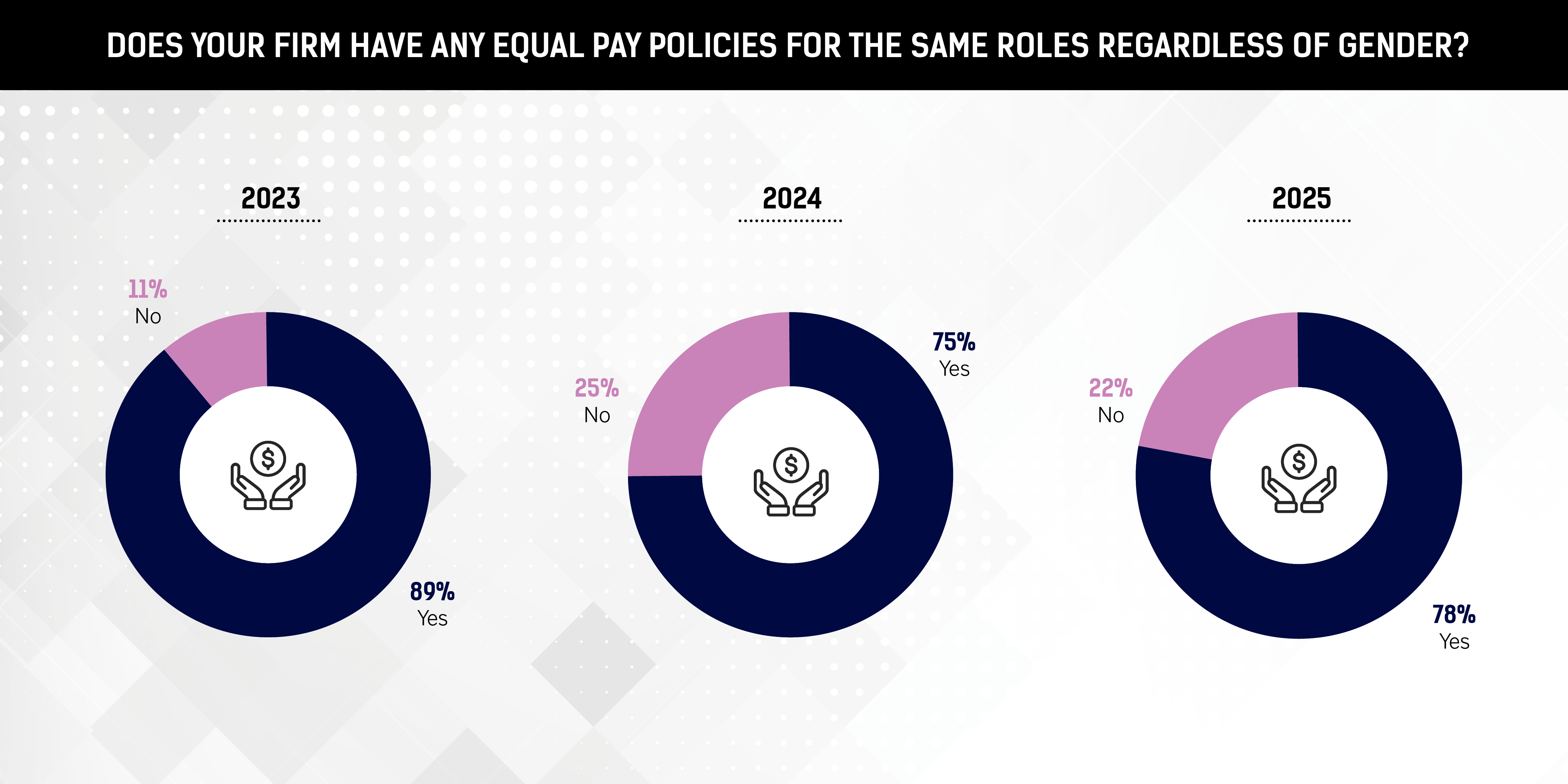

The EVP of data solutions at Informative Research says, “While I’m proud of where I am today, I’d be remiss not to acknowledge that systemic barriers do still exist for many women. The industry has made progress, but there’s still work to do. We need to continue addressing pay equity, expanding leadership opportunities, and fostering cultures where women are actively supported in their rise to the top.”

1. Systemic male-dominated culture

Nearly every woman highlighted the persistent legacy of male-dominated leadership in the mortgage and financial sectors.

Many describe having entered the field when the “good old boys’ club” dominated decision-making, making it difficult to gain credibility, voice opinions, or be taken seriously.

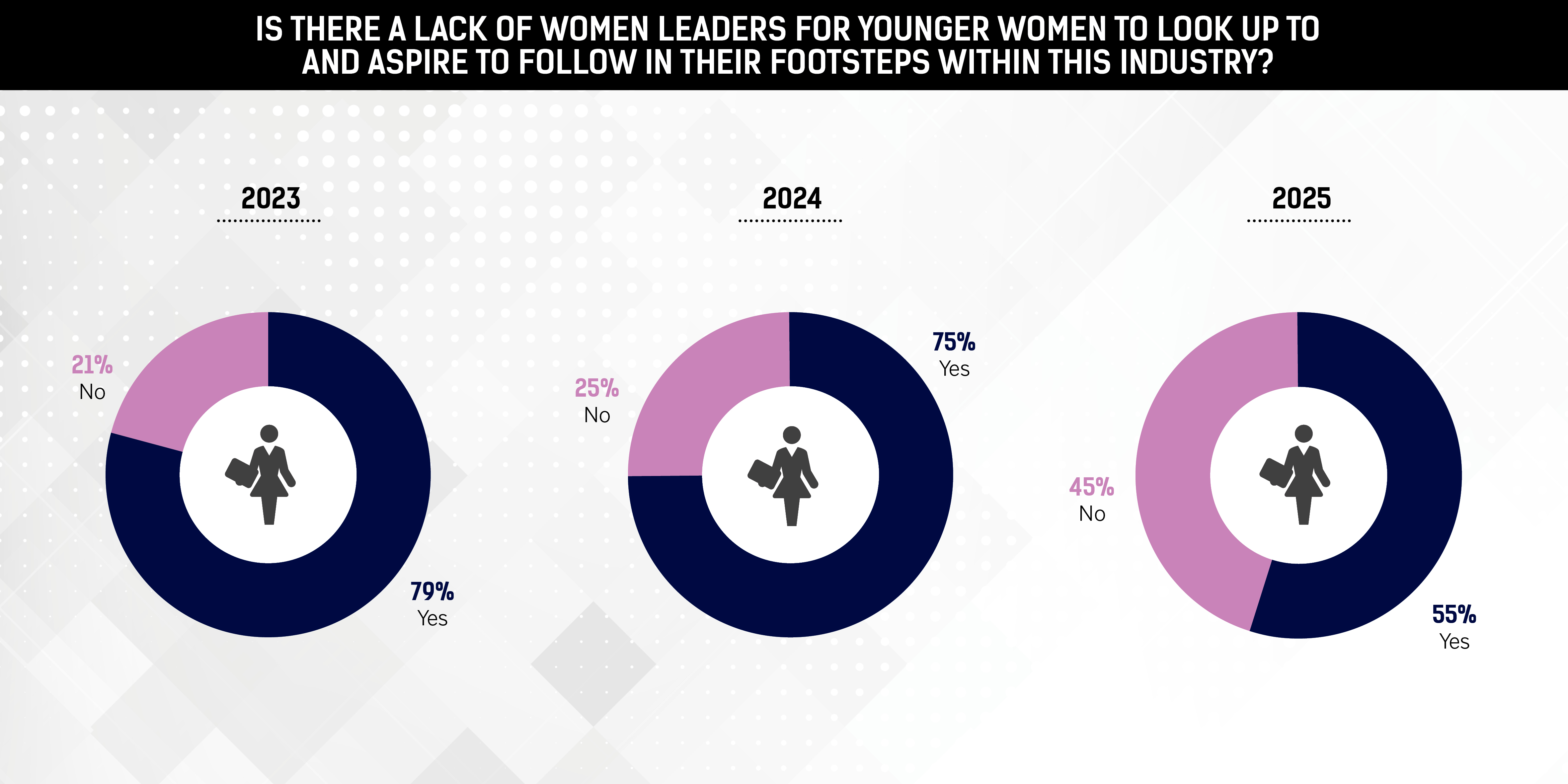

2. Lack of representation and mentorship

A recurring issue is the limited number of female leaders, mentors, and role models in the industry, particularly in executive and board-level positions.

This lack of visibility hinders both growth and confidence, especially for newcomers.

3. Balancing career with personal and family responsibilities

A major theme is the pressure of juggling motherhood, partnership, and caregiving while striving for excellence in a high-demand industry.

Many describe this as a “double burden,” with expectations to perform at 100 percent both professionally and at home.

4. Unconscious bias and gender stereotyping

Women often encounter bias in leadership evaluations, with perceptions that they are too emotional, not as career-focused, or in need of male validation for decisions.

This creates a need to “prove themselves twice” − once for competence and again for legitimacy.

5. Navigating career growth and advancement

A common struggle is forging a path to leadership in an environment where structural support is limited.

Some women noted they had to carve out their own paths, as they were often steered toward support or admin roles instead of executive tracks.

6. Mental load and emotional labor

Many describe the emotional toll of constantly advocating for themselves and others while striving for professional excellence.

The emotional complexity of being a woman leader − especially as a caregiver − is rarely acknowledged in corporate settings.

7. Communication challenges and gendered dynamics

Some women reported being spoken over, ignored in meetings, or second-guessed in decision-making roles.

There’s also the awkwardness of men being overly cautious or “tiptoeing” around women in tough conversations, which can undermine collaboration.

Mortgage Professional America invited industry professionals from across the country to nominate exceptional female leaders for the ninth annual Elite Women list. Nominees had to be working in a role that related to, interacted with, or in some way impacted the industry and should have demonstrated a clear passion for their work.

Nominators were asked to describe the nominee’s standout professional achievements over the past 12 months, along with their initiatives and innovations and their contributions to the mortgage industry.

After a thorough review of all the nominations, the MPA team narrowed down the list to the final 40 Elite Women of 2025 who have made their mark in the industry.